How A.I. Beat the Stock Market by Examining Court Cases

How A.I. Beat the Stock Market by Examining Court Cases

Companies that lose in court will often end up losing in the stock market, too, and a Miami-based startup called Premonition is capitalizing on that basic truth.

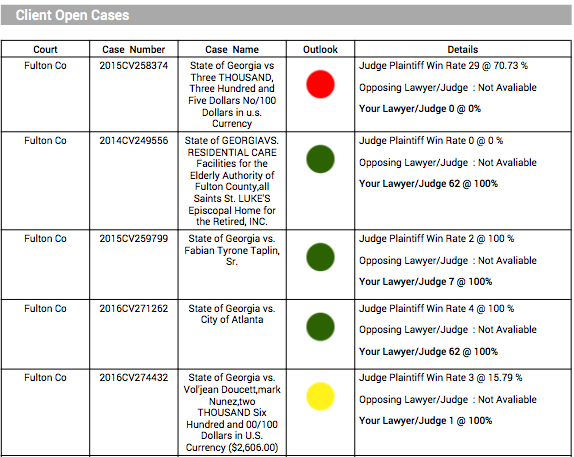

Premonition announced Thursday that it found a way to use its trove of data detailing how often lawyers win in court to predict changes to a company’s stock. It’s not exact — the company doesn’t know exactly how the price will change — but it’s good enough to know whether to buy or sell.

Toby Unwin, the company’s chief information officer, tells Inverse that Premonition isn’t quite sure how it wants to use this newfound ability. “It’s kind of like we’re the dog that caught the mail truck: We’ve got this thing that’s really cool, but we aren’t quite sure what to do with it,” he says. “So we’re hoping that we can find some people who can take this and really do something with it.”

Premonition is able to predict changes between eight months and two years out. It works best, Unwin explains, when used on banks with a narrow focus. The artificial intelligence won’t be able to predict what Bank of America’s stock is going to look like in 2018; a smaller bank that specializes in mortgages, on the other hand, is easier to analyze and predict because of its smaller focus.

Premonition was founded in 2014 to analyze the relationships between lawyers and judges. In order to do this, the company built the largest litigation database in the country, then developed algorithms that could make sense of all that data. The result is a system that can reveal how often lawyers win cases, what lobbyists are able to influence legislation, and other information that hides in plain sight.

Other companies are using artificial intelligence to help automate mergers orgive legal advice. Premonition is focused more on making sure people know what’s really happening in their courtrooms.

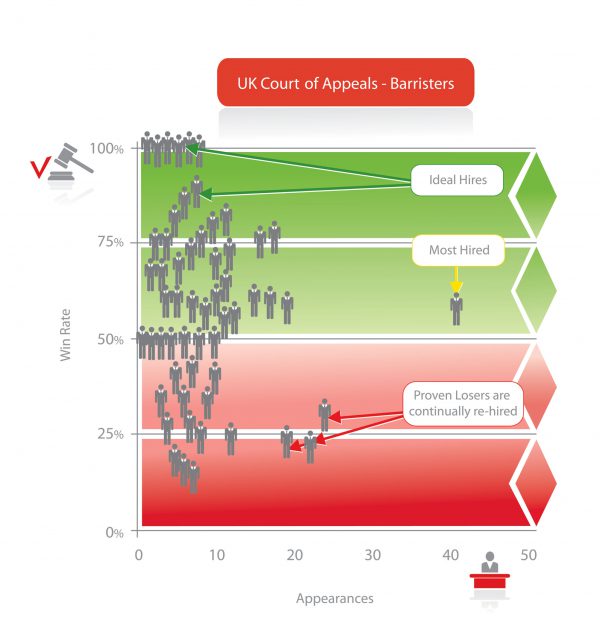

“It’s kind of a perception-reality arbitrage thing,” Unwin says. Premonition is able to figure out whether the $800-an-hour lawyer at a fancy firm is actually worth the premium, or if the $150-an-hour lawyer at a strip mall might actually have a better track record with a particular type of case. “This brings transparency, which also means that lawyers can stop overcharging their clients,” Unwin explains.

The company plans to expand to other areas that can benefit from its data analysis. In the meantime, it’s looking for someone who might be able to use its ability to predict how a particular stock is going to perform. That won’t be the company’s main focus, but one simply does not discover the technological equivalent to a crystal ball and decide not to glance at it every once in a while.