Lunch with Premonition … whilst gazing across London & into the future

Lunch with Premonition … whilst gazing across London & into the future

Some of us have to toil at our desks whilst other members of the team luxuriate in London skyscrapers, eating delicious sushi …

[Article written by Katia Lang and originally published in The Fintech Times]

LUNCH WITH …. Premonition

“Few businesses could be more contentious in their sector. The company seems to inspire a strong love / hate reaction in everyone who comes into contact with them, ambivalence isn’t really on the menu. It was time to see what all the fuss was about.

If you want to see the future sometimes it helps to get high, and from the 39th floor of Heron Tower you can see further than from the ground. Lunch with Premonition was at SushiSamba, and yes, it was predictably and delicately delicious.

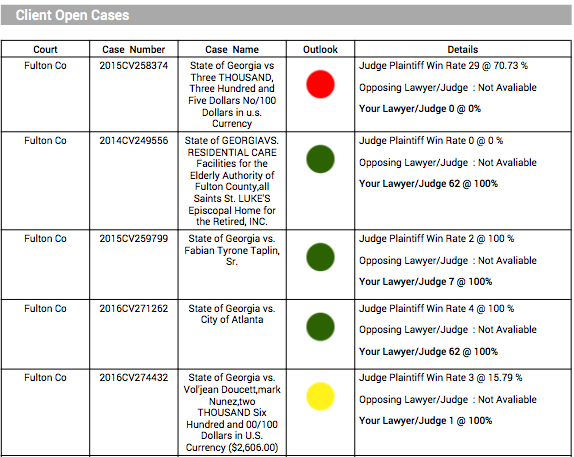

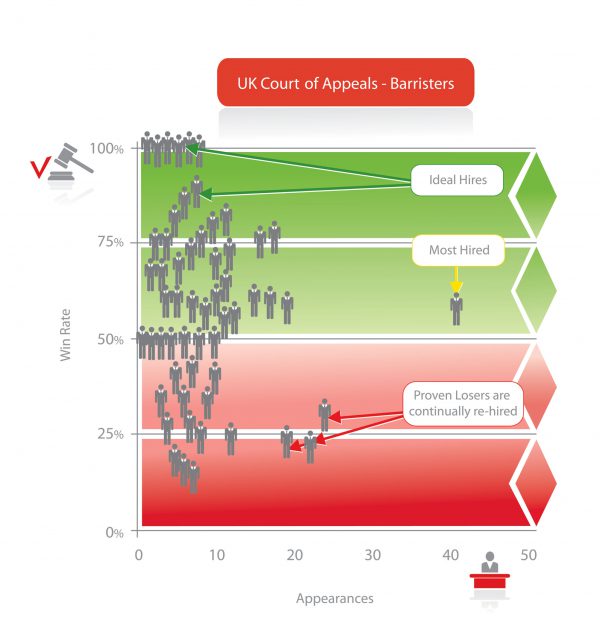

Sitting round the table, listening to the extraordinary business that is Premonition. ai, taking notes on my iPad pro, nibbling at tempura sea bass and wafer thin slices of Wagyu and what I recall as a ribeye served on hot stones and a succession of delicacies, it occurs to me life could be worse. It also occurs to me, as I savour the fusion of artificial intelligence, law and finance, with a blended foam terminology of each, that “Understanding relationships gives one the ability to make predictions, to see what others cannot.” The company calls this “Perception / Reality Arbitrage”. Pretentious? Maybe, but also compelling. It’s one of the most interesting businesses I’ve seen for a long time. I’ve gone back to their website a few times since, each time picking up a different nuance, seeing a different thread in an artfully woven strategy. Prepare to get your mind blown. They’re applying AI to law, and the bitter sweet insights juiced from the dynamics of these two sectors are fascinating.

Here’s a single example to demonstrate the principle. Imagine being able to predict share price movements in 6 months’ time. Not exactly, but specifically, the company, and the direction, shares up or shares down in price. If you’re a hedge fund manager, that information is maybe worth $100M that day. OK. Work it back. Airline Companies. At any time, 2,000 litigations are going through. Typical value, £0.5M to $5M. It’s normal. Quarterly performance reports. It’s normal. However, it’s knowable that in 9 months’ time, there’s going to be a statistically significant increased number of these litigation actions coming to court for a specific company with a spike in the activity of them being settled, and 50% will be concluded that month. It’s also knowable that a statistically significant number of them are going to have a particular outcome, 75% are going to be lost by the airline, against what would normally be an averageof 50%. It’s also knowable that the average liability on those will be $2M.

A few sketched sums:

• 2,000 litigations @ 50% being settled = 1000

• 1,000 @ 75% being lost = 750 • 750 x $2M = $1,500M liability

• Typical liability @ 50% being lost $1,000M

• Actual liability $1,500M

• Unexpected loss $500M

This will impact in the quarterly report in 9 months time. That will impact the share price. As they say, “Losing is expensive”. However, the poor performance is both tempura, sorry, temporary, and predictable. And the tempura is amazing, the sea bass cuts are meaty, more like monkfish. Therefore, a strategy for making profit from pillars of data, law, weather, oil price, political Subjects: Disruption, AI, Lawtech, Sushi • Premonition | www.premonition.ai activity, one is able to acquire predictive data for, the more complete the picture. Providing you are able to cross- reference the impact of one against the other by understanding the relationships between them.

Understanding relationships. Between everything ultimately. The recipe for success. Buying the litigation winners in an industry and shorting the losers. Assembling perfect hedged trades based on information no other company can derive. I don’t know whether they teach that in business schools. Maybe they should. One more stat fromPremonition.ai Women partners are better than men partners at law. They have a higher win ratio. It’s a fact. Perhaps for the reason outlined above. Premonition give me much more to digest than just this outline example, and also share the principles they hold to operate as an agile and very disruptive company. But right now, I’m thinking about the sea bass. To be re visited, in both instances”