Premonition Releases Top 10 Win Rate Rankings for UK Lawyers

Premonition Releases Top 10 Win Rate Rankings for UK Lawyers

US-based legal analytics company, Premonition, has updated its 2017 UK High Courts Report to include the top ten law firms and barristers by case win rate.

Premonition uses natural language processing to extract information from public court documents to find out which lawyers won or lost a case for their clients. The latest data analysis focused on the High Courts of England & Wales, from Family to Patents, examining over 11,000 cases between 2014 and 2016.

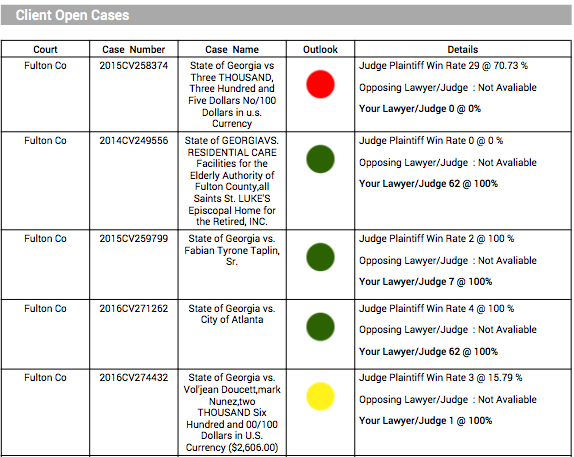

For example, in the Commercial Court, Premonition has set out the top 10 law firms with a win rate between 60% and 80%, with each firm handling at least five matters (see below).

While the top 10 includes some big names in commercial litigation that one would expect to see in the UK, such as Herbert Smith Freehills and Allen & Overy, it does not include several other firms that are usually well-regarded in legal directory sections for commercial litigation, such as that of the well-known directory, Chambers.

For example, global law firm Clifford Chance, which Chambers ranks as an ‘elite’ firm in the UK for commercial disputes, does not make it into the Premonition top 10 based on public win rate data for the Commercial Court.

Conversely, one small litigation firm, PCB Litigation, which specialises in fraud, is included in the top 10 because of its high win rate in the Commercial Court compared to the rest of the market.

‘At the risk of sounding harsh, every other legal award in the UK is at best subjective, and at worst, pay-to-play nonsense,’ stated Premonition CIO and co-founder Toby Unwin. ‘With our new report, firms and general counsels can see who has backed up their reputation with real success in litigation.’

Some of the other overall findings include the statistical fact that plaintiffs in English courts win their cases 75% of the time, which is more than double the US figure and that self-represented litigants i.e. litigants without a lawyer, generally beat expectations and were often very successful in court.

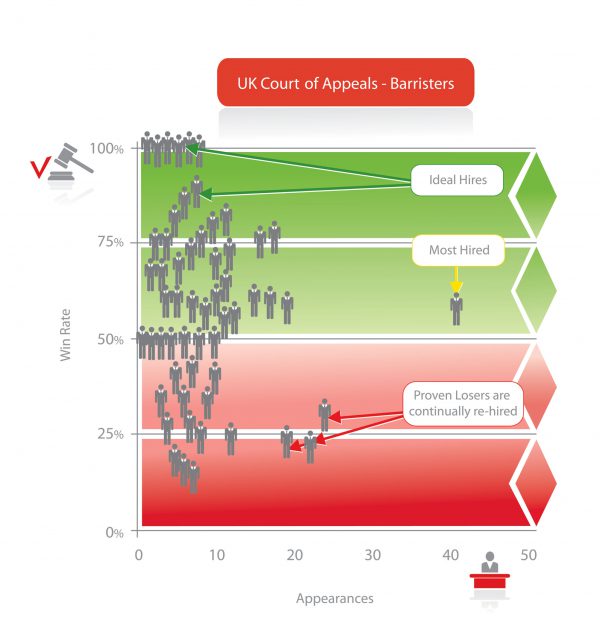

Premonition co-founder, Unwin, added that after analysing the overall win/loss data they had found that ‘a law firm’s choice of barrister was 38% worse than random and general counsel’s choice of law firm was 18% worse than random’.

Countering the ‘legal Money Ball’ approach some have argued that presenting win/loss data for lawyers doesn’t give a full picture as many clients seek to settle in private and avoid a court battle that would leave a public record of a win or loss rate for the lawyers. I.e. a firm could potentially be a great litigation advisor but rarely enter a court room for a client and hence not leave a data trail that could be analysed. In which case, they would not be in the table, even if clients had a high regard for them.

The counter argument to that is: would you not rather have a law firm that public data shows can win cases if it comes to court? In short, even though data-based review of law firms is not the entire picture, it is at least factual.

That said, one could ask whether inhouse legal teams will change their choice of law firm based on data. More inhouse teams at large corporates are certainly collecting data on panel firm performance and Premonition’s findings would presumably be of great help there.

Meanwhile, litigation funders will no doubt also wish to collect as much data as possible on a matter and the potential lawyers involved before committing funds to a dispute.

However, many lawyer-client relationships remain highly subjective, often based on personal trust, belief in the firm’s brand or simply recommendation and a general feeling in the market that firm X or Y is best. While inhouse teams do shake up panels from time to time, to dump a long-standing adviser to replace them with new advisers based primarily on win data analysis would be a departure from the norm. Other issues such as pricing, their ability to work well with the firm’s partners and long term connections to a certain firm, may also all play a part.

That said, as inhouse legal departments become more data-focused and collect detailed performance metrics, including more accurate billing information, proof of win/loss rates could become more of a benchmark for winning work. It does seem inevitable that as more data is collected that clients will inevitably start to make better use of it, even if this will not happen over night.

The full UK report and reports for other markets can be found: here.